|

HOME » TOTAL FINANCIAL PLANNING |

| |

Make My Wealth - Total Financial Planning |

| |

| Wealth Investment Method |

1. Plan objectives of the customer

2. Analyse when will the customer needs money most

3. How much amount will he need?

4. Analyse the cost of inflation

5. Work for the customer’s financial need backwards

6. Finally we get down to the amount the customer needs to invest

|

Our financial experts study every product and our customer’s potential and then recommends the best financial plan for him. Financial planning can be viewed as the procedure of attaining life goals through proper management of finances. Life goals can include buying a home, saving for your child's education or planning for retirement. Financial planning process consists of six steps that help you to examine your present financial situation. Using these steps, you can work out what you may need in the future and what you ought to do to reach your goals. |

|

| |

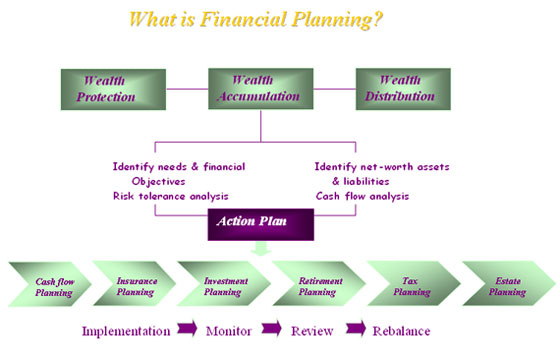

Financial planning is about three things – Wealth accumulation, Wealth protection and Wealth distribution. The four legal ways to create wealth are by marriage, by inheritance, by winning lottery and by spending less than you earn. Only one of those options is realistic for most people.

Financial plan need to be reviewed and revised on a regular basis as life and circumstance change.

- You have to make sure that you are on the right track to meet your goals

- Ensure that the financial tools you are employing still meet your needs.

- Identify new goals.

|

| Financial Planning Process |

- Setting short, intermediate and long-term goals.

- Evaluating your current situation - cash flow analysis and calculating your net worth. You need to assess your current financial status, including positives and negatives.

- Assess and review your current tax situation so that you can identify tax-saving opportunities and potential deductions.

- Review your insurance coverage, including life, disability, home, liability and long-term care.

Review your estate plan to ensure that your will, living will, healthcare power of attorney and other estate planning documents are valid and up-to-date.

- Build up a retirement funding plan that covers when you plan to retire and how much you will need to support your retirement lifestyle.

- Develop a college funding plan for your children’s higher education.

|

Finally develop an overall investment plan with proper investment portfolio that supports your goals, while staying within your investment time horizon and risk tolerance. All of these areas will help you develop your initial financial roadmap. Review your plan and progress periodically by giving yourself an annual check up to make sure you are staying on track. Life will throw you a googly from time to time; a serious illness and an unexpected job loss can all affect your financial plan. So be prepared and be flexible. |

| |

How to Make Financial Planning Work for You? How to Make Financial Planning Work for You? |

| To pull off the best outcome from your financial planning, you have to be prepared to avoid some of the common mistakes by considering the following things: |

| |

Set measurable financial goals Set measurable financial goals |

| Set specific targets of what and when you want to achieve results. Instead of saying you want to be comfortable when you retire or that you want your children to give good education, you need to quantify what "comfortable" and "good" mean so that you'll know when you've reached your goals. |

| |

Review your financial situation periodically Review your financial situation periodically |

| Your financial goals may change over the years due to changes in your lifestyle or circumstances, such as an inheritance, marriage, birth, house purchase or change of job status. So revise your financial plan as time goes by to reflect these changes so that you stay on track with your long-term goals. |

| |

Understand the effect of each financial decision Understand the effect of each financial decision |

| The financial decisions you take will affect several areas of your life. For instance, a decision about your child's education may affect when and how you meet your retirement goals. That means all your financial decisions are interrelated. |

| |

Be realistic in your expectations Be realistic in your expectations |

| Financial planning cannot change your situation overnight; it is a lifelong process .It is a common sense approach to managing your finances to reach your life goals. Remember that events beyond your control such as inflation or changes in the stock market or interest rates will affect your financial planning results. |

| |

Start planning at the earliest Start planning at the earliest |

| Start financial planning as soon as you can. People, who invest small amounts of money early, tend to do better than those who delay financial planning. By developing good financial planning habits such as saving, budgeting, investing and regularly reviewing your finances early in life, you will be better prepared to meet life changes and can easily handle emergency situations. The average person in his 50s would have to save more than half his yearly gross income to retire at age 60, whereas a 30-year-old who starts saving just 10% of his income will be so flush with cash at retirement he'll have trouble spending it all. |

| |

Why Financial Planning Required? |

Financial planning is important for everyone .Financial planning for "regular" folks boils down to two things; first, you have to save some money to invest; second, you have to learn how to invest it. People are bombarded daily with financial and economic news that has little or no relevance to their lives. Stories about derivatives scandals, option puts and calls and the other arcane flotsam and jetsam of the financial world don't serve to educate most people; they just confuse them.

Financial planning takes on a critical role for everyone because most of us are responsible for setting up our own plans on Child Education, buying home and retirement. Whatever plan is chosen; financial planning is the key to making it work. Every person's goal is to be able to retire comfortably. You want your income in retirement to protect you against inflation and allow you to maintain your lifestyle. |

| |

“The most important thing is to start saving”

“No matter what your age or how little you can afford” |

| |

|

|